brand overview

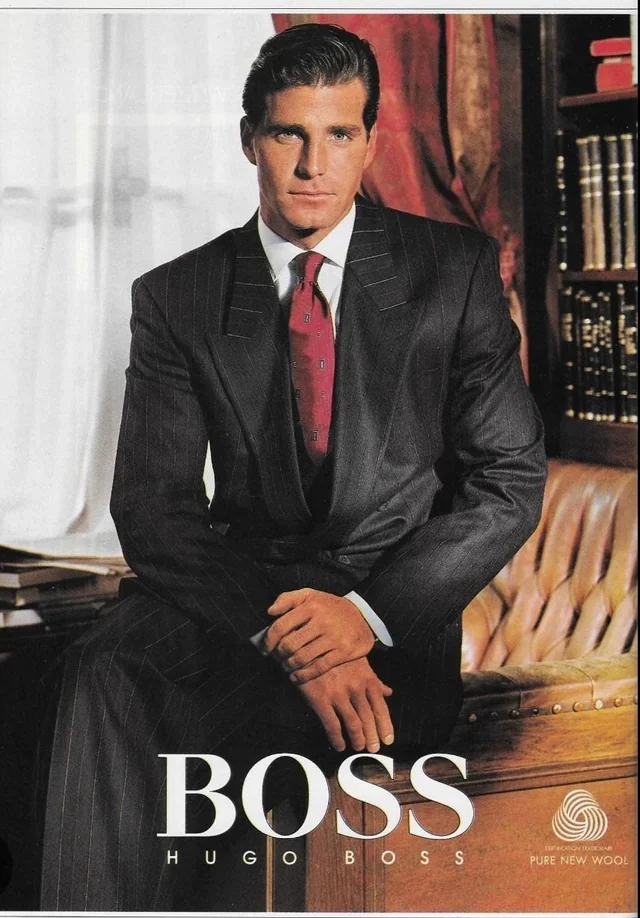

HUGO BOSS was founded in ‘1924’ in ‘Metzingen, Germany’ also where there Head Office is situated. They are a luxury apparel brand mainly known for their high-quality tailoring, the brand has transformed into a lifestyle fashion group operating under the brands of BOSS and HUGO. HUGO is younger fashion forward customer who are looking for edgier ‘clean designs’ whereas, BOSS represents a timeless style for everyday life, from ‘business and casual attire to eveningwear’ (HUGO BOSS, n.d.). In ‘2024’ HUGO BOSS’s ‘net income in million eur’ was ‘$224 million’ (HUGO BOSS, n.d.). The HUGO BOSS mission is ‘we love fashion, we change fashion’ and their values are ‘team mentality, Simplicity and quality, youthful spirit, entrepreneurial spirit, personal ownership’ (HUGO BOSS, n.d.). HUGO BOSS has collaborated with numerous global ambassadors and celebrities to improve their cultural relevant and engage a younger audience. Design collaborations in the past have included ‘David Beckham and Naomi Campbell’ (HUGO BOSS, n.d.). Campaigns featuring Anthony Joshua and Gigi Hadid reflect the brands shift towards inclusivity and expanding amongst international markets.

Pestel analysis

Political:

Global operations expose HUGO BOSS to chaining import and export regulations. HUGO BOSS operated across multiple SEAPAC markets including Korea, Japan, Singapore and Australia, all with different trade policies and regulations. Japan is politically stable providing a reliable market, however, US Tariffs and China trade disputes can indirectly affect business activities especially the supply chain. HUGO BOSS claims that ‘political and economic instability in individual companies can negatively impact our supply chain and distribution network’ (HUGO BOSS, n.d.).

Economic:

Luxury brands like HUGO BOSS are heavily reliant on consumer spending, with the luxury fashion segment in SEAPAC markets rapidly expanding, this is driven by rising disposable incomes and increased travel. Reuters sheds light on the fact that ‘pent up demand and the return of travel continues to support premium purchases’ particularly in Asia’, however with currency constantly fluctuating in certain markets for HUGO BOSS it remains a challenge for pricing to remain profitable.

Social:

Consumer behaviour in Japan emphasises, self-expression, inclusivity, and lifestyle alignment to the HUGO BOSS brand. For example, in Japan the genderless fashion trend of jendaresu-kei creates opportunities for a unisex clothing range. HUGO BOSS exemplifies brand values around ‘self-determination, individuality and confidence’ aligning with a younger consumer who is seeking social progressiveness and personalisation within a clothing range (HUGO BOSS, n.d.). A collaboration with an artist like Sound of Coups can strengthen this connection.

Technological:

Digital retail adoption is trending in Japan with customers expecting seamless in person and online integration. HUGO BOSS has invested in ‘digital capabilities to deliver more personalised and seamless omni-channel experiences’ this includes the integration of virtual reality in dressing rooms (HUGO BOSS, n.d). This is available in ‘Germany, the UK and France’ where the customers body is measured up accurately reflecting how the garment will fit (Hughes, 2022).

Environmental:

Sustainability is a priority for many consumers. HUGO BOSS has committed in their Sustainability Report to ‘increasing their share of responsible materials’ and achieving ‘net-zero emissions by 2050’ (HUGO BOSS, n.d.).

Legal factors:

HUGO BOSS is obligated by the Corporate Sustainability Reporting Directive to report on ‘environmental, social and governances (ESG)’ as it is a legal obligation for businesses operating in the European Union (Sales Force, 2025).

retail analysis

Hugo Boss’ retail strategy spans across both their brick and mortar footprints and digital footprints. In 2021, Hugo Boss introduced their Claim 5 strategy which comprises of 5 pillars; Boost Brands, Product is Key, Lead in Digital, Drive Omnichannel and Organise for Growth. The five pillars are the ‘what’ of the strategy and the ‘why’ is consumer first. The way that Hugo Boss aimed to implement this through their ‘how’ strategy include being sustainable throughout, having rigorous execution and empowering people and teams.

Based on Hugo Boss’ annual report, in 2024 the company operated just over 1500 brick and mortar stores with 500 of those being freestanding retail stores globally (Hugo Boss 2024). The brick and mortar stores account for 52% of group sales in 2024 (Hugo Boss 2024). In terms of store improvement and omnichannel, around 80% of their stores are looking to upgrade with revamped stores inclusive of digital enchantments and creating a cohesive omnichannel experience (Hugo Boss 2024).

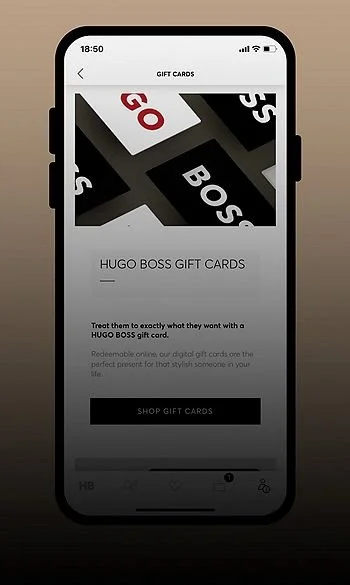

In terms of their digital retail, Hugo Boss launched their digital campus in order to enhance their analytics and tech capabilities across the value chain (Hugo Boss 2021). The company also have a Hugo Boss App and updated webpage, since 2022, which have improved overall consumer engagement and conversation (Hugo Boss 2022).

product analysis

Hugo Boss operates through two distinct brand pillars: BOSS and HUGO. BOSS positions itself as a premium lifestyle brand focused on tailoring, while HUGO targets younger, trend conscious consumers. The recent introduction of HUGO BLUE has expanded their denim and casualwear offerings, while licensed categories like eyewear, fragrance, and kidswear broaden the lifestyle ecosystem without compromising apparel's premium positioning (Hugo Boss, 2025a). In Japan, price segmentation reinforces this strategy—BOSS tailoring ranges from approximately ¥96,800–¥171,600, while HUGO sneakers and t-shirts provide more accessible entry points at ¥6,930–¥43,560 (ZOZOTOWN, 2025).

To drive global visibility, Hugo Boss leverages high-profile celebrity campaigns. The David Beckham x BOSS bodywear campaign in 2025 revitalized men's underwear and loungewear, while HUGO BLUE embraced denim and music culture to connect with Gen Z (Hugo Boss, 2025b). In Japan, the brand adapts campaigns locally, most notably with "BOSS Selected by Shohei Ohtani," which pairs performance tailoring with national pride during the 2025 MLB Opening Series. Seasonal capsules and ambassador-driven activations at department stores like Isetan Shinjuku further strengthen brand storytelling (WWD Japan, 2025).

Hugo Boss takes a channel-specific approach regionally. Their owned e-commerce platform highlights premium tailoring and footwear, supported by ambassador storytelling and the "HUGO BOSS EXPERIENCE" loyalty program integrated with LINE (Hugo Boss, 2025a). Meanwhile, platforms like ZOZOTOWN and Rakuten Fashion cater to younger, price-conscious shoppers, particularly for HUGO casualwear and sneakers. Department stores remain essential for BOSS, facilitating experiential activations and premium service (WWD Japan, 2025). This dual-channel strategy preserves the brand's premium equity while expanding its reach across diverse consumer segments.

CONSUMER ANALYSIS

~

CONSUMER ANALYSIS ~

CONSUMER 1

DEMOGRAPHICS

The primary BOSS customer specific to the SEAPAC region of Japan is likely to be a millennial male, and therefore between 34–44, with an Asian ethnicity and a tertiary level of education, likely in an area of law, medical, finance, or commerce. As such, this consumer is likely to work as a lawyer, doctor, financial adviser, CEO, or business owner. Due to the highly successful nature of their career, he is likely to be a high-income earner, and thus could be expected to be earning over ¥8M per annum. They are most likely to speak Japanese, and English as their second language. This consumer is likely to be married and potentially have a family of their own.

GEOGRAPHICS

Given this customer is to be expected to be highly wealthy, affluent, and overall a high-income earner, it could be expected that he lives in a status quo residential area that reflects this. Indeed, it can thereby be assumed they live in wealthy, affluent suburbs such as Minato, or Akasaka, or other major business areas where wearing suits is the norm. This can also be supported by the fact that Hugo Boss has recently created a flagship store in Tokyo; suggesting it is a primary area of residence or, at a minimum, somewhere they spend their time.

PSYCHOGRAPHICS (AIOs)

The BOSS is likely to work in a professional role, where wearing suits is expected. Indeed, he likely attends business conferences and events, attends high-profile dinners, and travels both for work and out of interest. When flying, he is likely to fly business, and when travelling for personal reasons, often can be found on affluent holidays that reflect his social status, such as Dubai. Outside of this, the BOSS customer is likely to participate in higher-class and prestigious sports, such as tennis and golf.

He is furthermore likely interested in fashion and presenting himself well-dressed; specifically with a well adapted taste for suits and tailored pieces. Indeed, he is likely to additionally enjoy fine dining experiences, and often attends nice restaurants with his wife on a weekend, and may be likely to be partial to luxury cars that he can add to his collection.

This BOSS customer could be predicted to have strong opinions of fashion and style, and consequently value high quality and superb craftsmanship. Indeed, they believe the way they dress and how they invest in themselves through fashion reflects their position, and thereby they must dress the part. He is likely to be determined to continue building success and stature, but also strives to spend time with family.

BEHAVIOURAL

This BOSS customer is unlikely to buy impulsively, and instead shops with extreme thought and consideration. Indeed, this customer is likely to be incredibly brand loyal, especially to stores offering loyalty programs and premium experiences for high-valued customers. The customer is likely to purchase a new suit or associated items for upcoming events, such as a business lunch, family occasions, or overseas trip; and can be predicted to purchase suits, shirts, watches, belts, shoes, fragrance, and briefcases.

CONSUMER PROFILE 1:

Haruto Satō

Name: Haruto Satō

Age: 43

Occupation: CEO

Income: ¥8.3M

Background: Born and raised in Japan, with Japanese heritage on both his mother’s and father’s sides.

Language: Fluent in Japanese, both also does speak English

Relationship Status: Married for 16 years with a daughter and a son, both under 10

Bio: Haruto Satō is an affluent 43-year-old millennial CEO, set on expanding his wealth and developing his portfolio. Haruto is married with 2 kids, whom he enjoys spoiling. Haruto is incredibly specific with what he wears and where he purchases from, as he always ensures it fits his curated pattern and makes him powerful and sleek; whether that be travelling through the airport to a business class flight, at a business conference, or simply at golf.

CONSUMER 2

DEMOGRAPHICS

This BOSS consumer is likely to be a more up-and-coming consumer that is a 24–28-year-old male, and a middle to high-income earner. Indeed, this consumer likely earns approximately ¥4M–¥6M, having recently finessed their tertiary studies and advancing their careers in areas of marketing, tech, and finance, due to the demand for these careers in Japan. They’re likely unmarried and potentially single due to the rising trend to remain single in Japan.

GEOGRAPHICS

Similarly to the first persona, it is likely the second, Gen Z consumer is likely to live in high-income, central areas. This may include cities of Tokyo and Osaka, and specifically Ginza or Aoyama, due to their high-end shopping and dining scenes, luxury boutiques, and residences. This individual is likely to be living alone, and potentially moved into their own space, and enjoys these areas due to the saturation of their interests being dominated in this space.

PSYCHOGRAPHICS (AIOs)

This BOSS consumer is likely to have active social lives, and thereby enjoys spending time with friends. As such, they’re likely to spend an abundance of time going to trendy cafes and bars and exploring the modern Japanese food scene, and are additionally likely to participate in wellness-related activities such as yoga. These Gen Z consumers additionally may actively embark on travel ventures, both within Japan, such as, to Osaka; and internationally to South Korea, Hawaii, or Australia; ultimately enjoying places with high levels of culture attached.

The Gen Z BOSS consumer is likely to be incredibly active on social media; both posting their own day-to-day activities such as their most recent bar attendance or travel venture, as well as following their friends and favourite influencers, celebrities, or athletes. Indeed, they are also likely to be interested in fashion and see fashion as a vehicle to express their personal identity and craft the version of themselves they’re attempting to create and put forth, and as such, likely to enjoy going shopping. They’re likely very interested in cultural events and scenes with friends, such as attending concerts.

This BOSS consumer values high-quality and sustainability-driven fashion, and appreciates brands that are transparent. They’re very easily influenced by trends and social media, and therefore likely to purchase things if seen by people they know or people of influence who inspire them. They have reached an age where they have become more career-driven and less irresponsible and therefore care how they’re perceived.

BEHAVIOURAL

This generational cohort is slightly more impulsive in their purchasing habits; however, they are starting to adopt more slow approaches due to a growing value for longevity (Wahi and Ho 2025). Additionally, whilst they do enjoy shopping in premium stores, they are more likely to shop online due to frequency and convenience. They use fashion as a form of self-expression and are therefore more likely to purchase goods that reflect ‘who they are, and not just what they can afford’ (Lim 2025). As such, this cohort has an increasing appreciation of luxury; specifically, that which offers personal connection and expression (Lim 2025). In that said, they also love streetwear; especially if the two can be bridged, and enjoy branding on certain pieces.

CONSUMER PROFILE 2:

KENJI ITO

Name: Kenji Ito

Age: 26

Occupation: System Engineer

Income: ¥5.1M

Background: Japanese, with Korean heritage on his mother’s side

Language: Fluent Japanese, limited English and Korean

Relationship Status: Single

Bio: Kenji Ito is a Gen Z, 26-year-old System Engineer, living in Aoyama. Kenji is passionate about advancing his career and enjoys the Japanese food and culture scene; often cafe and bar hopping or attending music events with friends. Kenji equally enjoys quality fashion and styling; using it as a tool to craft his personal identity, both in the office and on the street; and is especially partial to luxury brands that create connection and personal experiences.

marketing analysis

Like the premium, versatile and long-lasting suits and apparel the HUGO BOSS the brand similarly uses marketing to foster long-term loyalty and community for their Hugo and Boss customers.

The brand drive a seamless, high-quality omni-channel marketing experience for its SEPAC and global audiences.

They particularly focus on their 360-degree brand campaigns that align with their “Claim 5” growth strategy- to increase their exposure, relevance, growth and market share for both their BOSS and HUGO brands (Hugo Boss Group, 2024). Since the launch of this strategy, Hugo Boss Group has invested approximately 8% of sales in their marketing channels and strategy annually.

This includes initiatives such as brand events, influencers such as global K-pop sensations- S.Coups, collaborations, pop-up stores and storylines behind their collections.

MARKETING ANALYSIS

To keep up with rapid worldwide technological demands and digitization, particularly in our focused SEAPAC country- Japan, Hugo Boss focuses their marketing towards being an innovative, “leading premium tech-driven fashion platform” for consumers (Hugo Boss, 2024). An example is their use of digital showrooms, using AI to create 3d visuals of their products for consumers, in attempt to keep up with rapid technological demands.

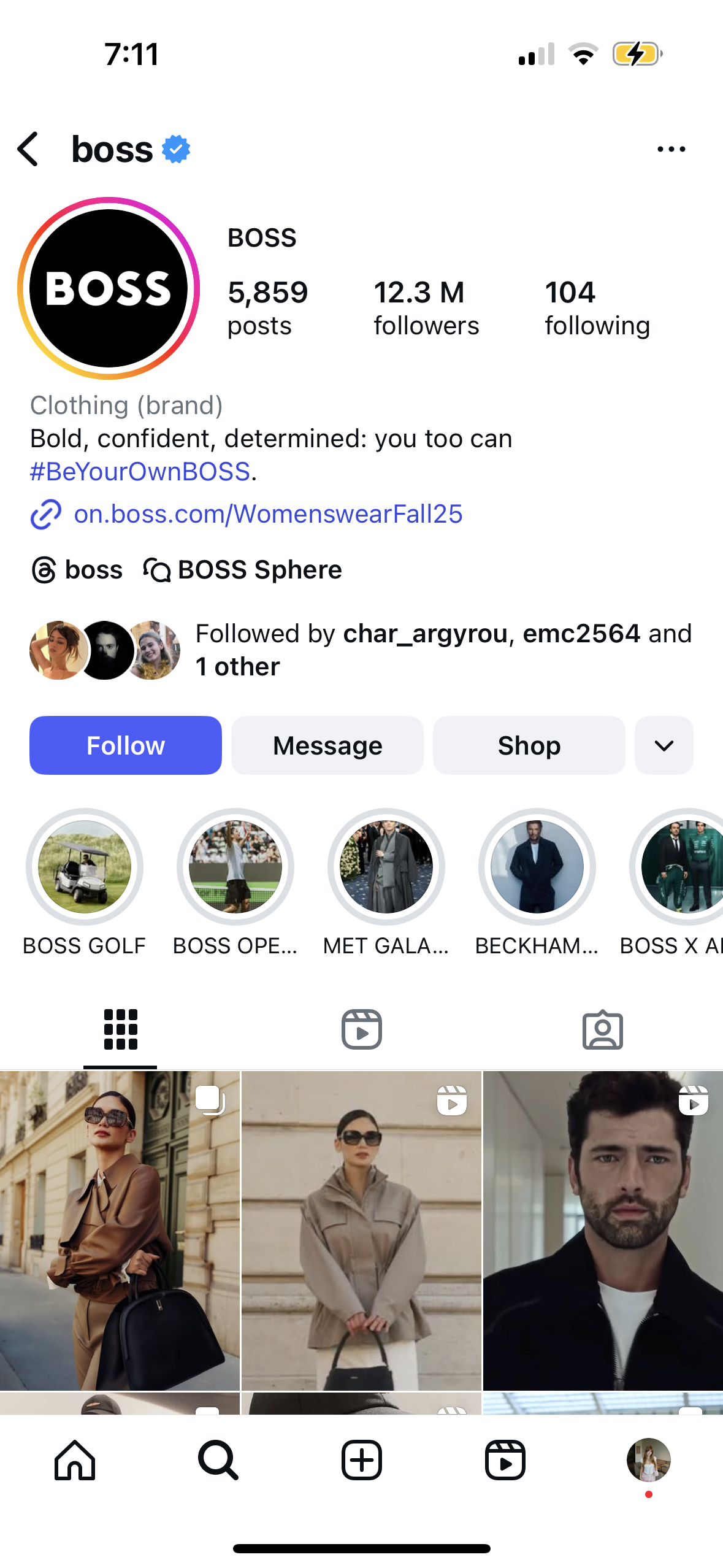

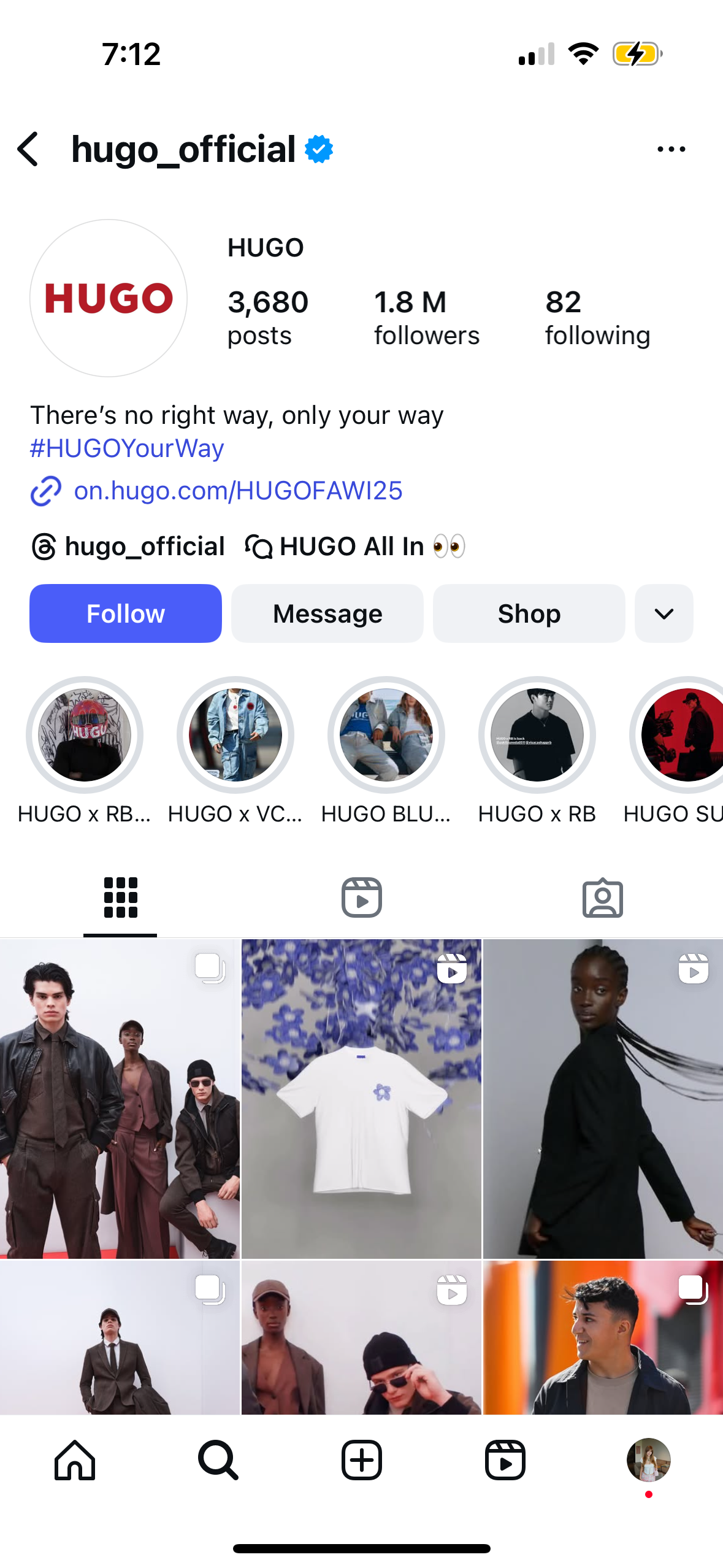

Digital marketing strategy is shown through Hugo Boss’s strong and leading social media presence.

Their social Media accounts are split into their two main brands- Hugo and Boss, appealing to the global market. Their most dominant platform is Instagram, their BOSS account sitting at 12.3 million followers and Hugo at 1.8 million (Instagram, 2025).

Boss social media has a strong, dominant and luxurious brand image across their photography and videography, whilst Hugo is more playful, experimental and youthful, reflective through colours, captions and content.

Marketing analysis

Marketing analysis

Hugo Boss has a strong focus towards the customer as their top priority though their dedicated Hugo Boss app. To leverage a personalised omnichannel experience for the customer, the company introduced Hugo Boss XP, a loyalty program where customers using the app and website can generate digital tokens for exclusive benefits (Hugo Boss Group. 2025). Members are also granted exclusive access to newsletter marketing communication to “BE YOUR OWN BOSS” (Hugo Boss Group, 2025).

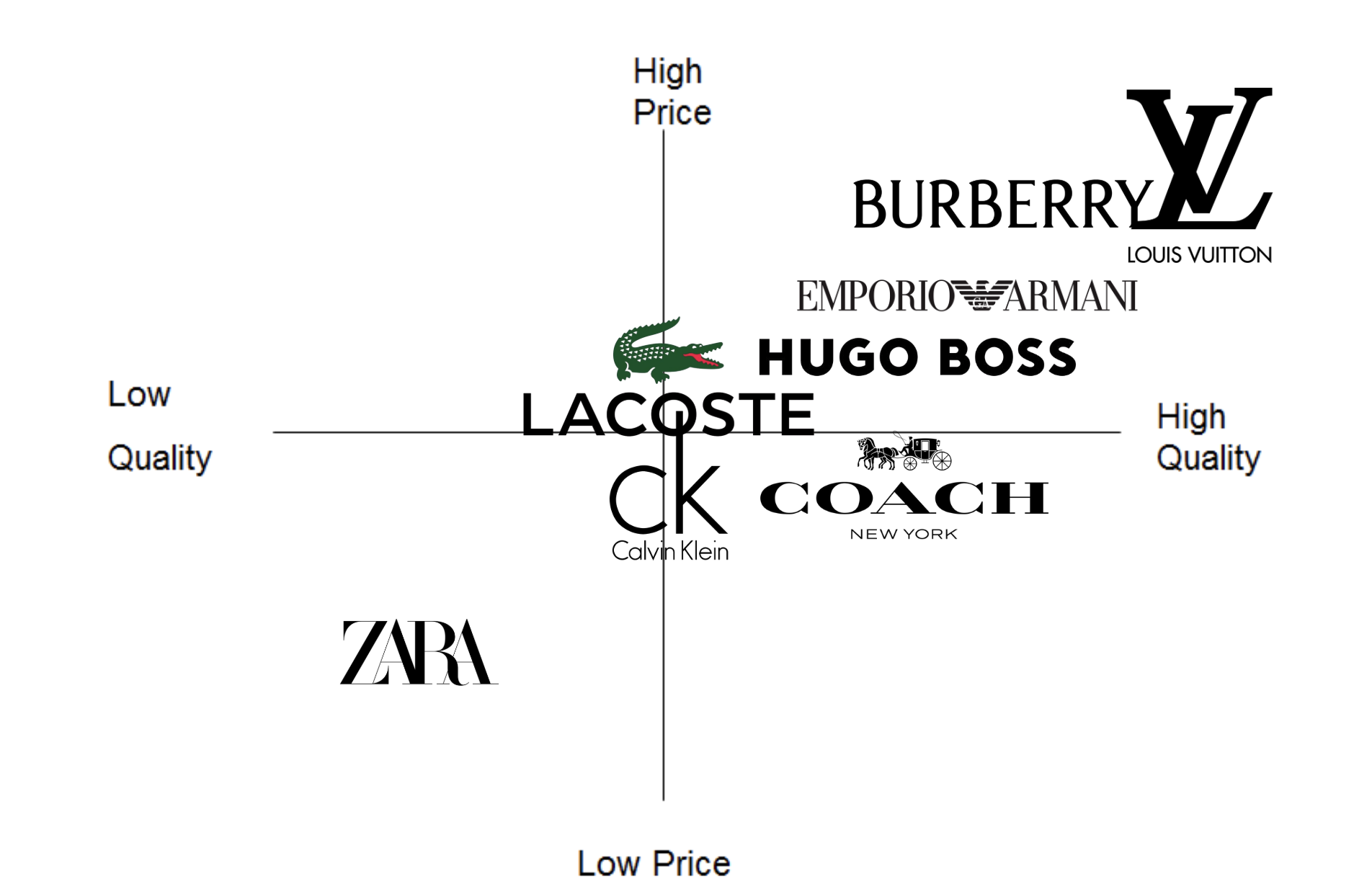

competitor analysis

Armani is the strongest competitor for Hugo Boss in terms of product, vision, quality and price: Armani’s main sub brand is Giorgio Armani- similarly focusing on men’s tailoring, refined suits, jackets and classic suit pants. They focus on high quality, timeless pieces essential for the wardrobe, and sit in the same premium price points as Hugo Boss (Giorgio Armani, 2025). Similar to Hugo, Armani has a sub brand- Emporio Armani, focusing on more fresh, youthful and trendy clothing pieces

.Burberry is another similar competitor to Hugo Boss. The brands share similar qualities including their classic style, timelessness and craftsmanship as well as selling sophisticated menswear. However, Burberry sits at a higher price point, appealing to more affluent customers than Hugo Boss.

Lacoste is another close competitor in the market. The two brands share similar product styles, particularly in polo shirts and other menswear items and hold similar price points. However, Hugo Boss stands out for its tailored and refined business staples, whereas Lacoste is known for its sporty and preppy aesthetic.

Calvin Klein is considered a close competitor to Hugo Boss for its similar range of accessories, clothing and selection of fragrances. Both brands offer premium, high-quality staples, however, Hugo Boss pitches to more affluent customers with its higher price points.